Financial Results

INTERIM FINANCIAL INFORMATION FOR THE SECOND HALF AND FINANCIAL YEAR ENDED 31 DECEMBER 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

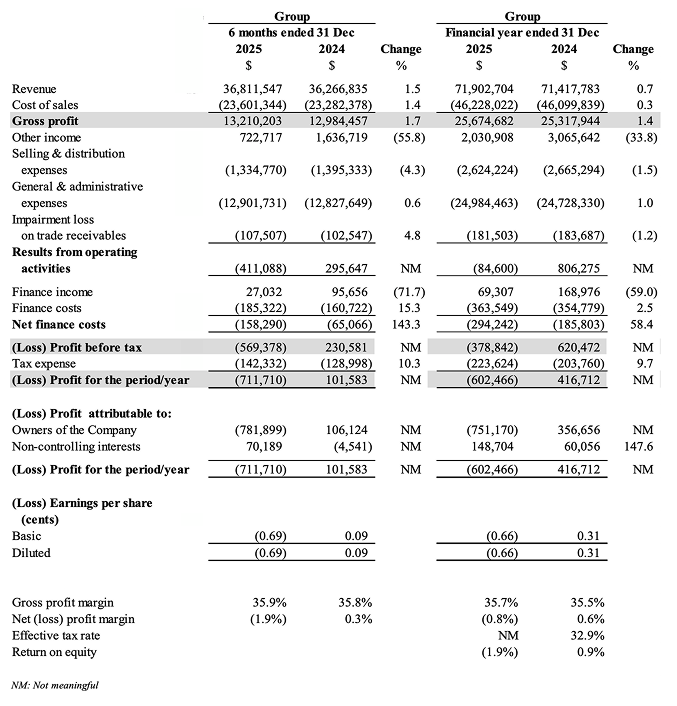

CONSOLIDATED STATEMENT OF PROFIT OR LOSS FOR THE SECOND HALF AND FINANCIAL YEAR ENDED 31 DECEMBER 2025

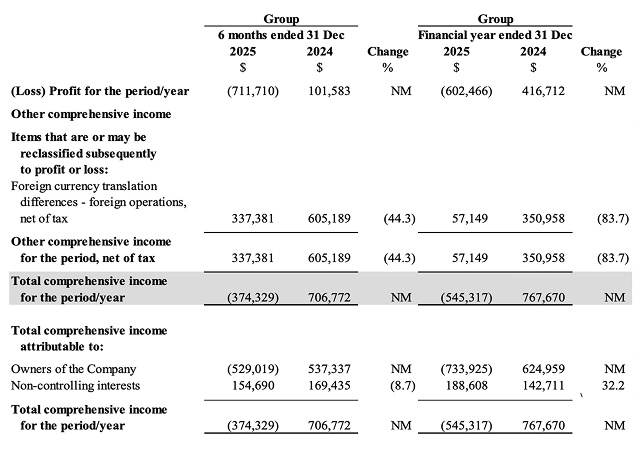

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE SECOND HALF AND FINANCIAL YEAR ENDED 31 DECEMBER 2025

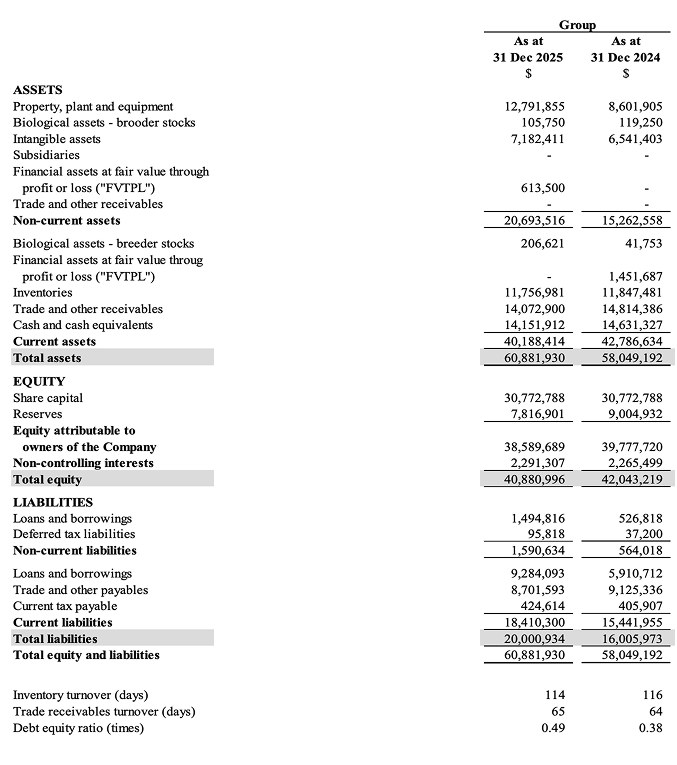

STATEMENTS OF FINANCIAL POSITION

REVIEW OF GROUP PERFORMANCE

Consolidated Statement of Profit or Loss

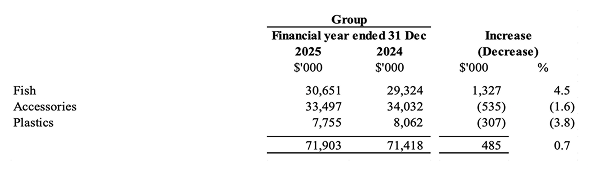

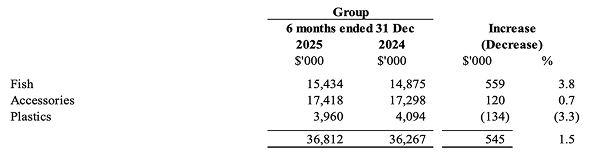

Revenue by business segment

Financial Year 2025 vs Financial Year 2024

On a geographical basis, revenue from Singapore grew by 1.9% in FY 2025, while overseas contributions remained broadly stable, with higher sales to Europe offset by lower revenue from certain Asian countries, as compared to FY 2024.

6 months ended 31 December 2025 vs 6 months ended 31 December 2024

Notwithstanding on-going trade tensions and a challenging geopolitical landscape, revenue from our fish segment increased by approximately $0.6 million or 3.8% during the current financial period. Our aquaculture business continued to benefit from a broader range of products and offerings, which supported an increase in customer orders, and contributed to the stronger revenue performance of this segment in the current financial period as compared to the corresponding period in 2024.

Accessories

Revenue from our accessories business improved marginally by $0.1 million or 0.7% in the 2 nd half of 2025 as compared to the corresponding period in 2024. The increase was primarily driven by the launch of new product lines and the enhancement of distribution channels, which facilitated the business's penetration into new markets and the growth of its customer base during the financial period.

Plastics

Our plastics activities recorded a slight decrease of $0.1 million or 3.3% in the current financial period as compared to the corresponding period in 2024. Despite this, we maintained a stable customer base by focusing on the sale of products with sustainable margins, including essential items supporting hygiene protocols in the healthcare and waste management sectors, as well as products serving the hospitality segment.

The decline in other income in the 2nd half of 2025 and in FY 2025 was mainly due to the nonrecurrence of the one-time compensation income received arising from a land expropriation by the local government in China in FY 2024, as well as a net change in fair value of an financial asset in connection with the acquisition of Aquaeasy. In addition, there was a decrease in handling income which was in tandem with the lower level of transshipments activities during the current financial periods.

The reduction of selling and distribution expenses in the 2nd half of 2025 and in FY 2025, despite a slight increase in revenue, was primarily attributable to targeted promotional campaigns, enhanced operational efficiencies in the distribution network and improved cost control measures across the business.

General and administrative expenses increased by approximately $0.1 million or 0.6% and $0.3 million or 1.0% in the 2nd half of 2025 and in FY 2025 respectively, as compared to its corresponding periods in 2024, mainly attributed to investments in IT infrastructure, and startup costs associated with newly incorporated business units in Malaysia and Indonesia. These increases were partially offset by lower staff-related expenses and reduced utility costs incurred during the current financial periods.

The impairment loss on trade receivables was determined by ascertaining the expected credit losses arising from all possible default events over the expected life of the receivables during the financial period, in accordance with SFRS(I) 9 Financial Instruments.

Despite lower interest rates charged by financial institutions, additional bank borrowings undertaken for the acquisition of a freehold office-cum-warehouse building in Selangor, Malaysia, coupled with the reduction in finance income due to the prevailing lower interest rate environment, has resulted in an increase in net finance costs by $0.1 million or 143.3% and 58.4% in the 2nd half of 2025 and in FY 2025 respectively, as compared to the corresponding periods in 2024.

The tax expense was mainly in relation to the operating profits registered by the profitable entities within the Group. Despite the utilisation of available tax credits, the effective tax rate was higher than the amount derived from applying the statutory tax rate of 17% to profit before tax. This was mainly due to losses incurred by certain entities that could not be offset against profits of other companies within the Group, as well as the impact of differing statutory tax rates in the jurisdictions where the Group operates.

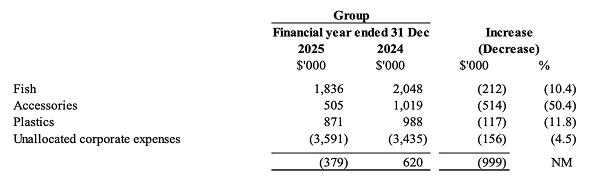

(Loss) Profit before tax by business segment

Financial Year 2025 vs Financial Year 2024

Despite an increase in overall revenue in FY 2025, profitability across all business segments declined as compared to FY 2024. The reduction in profitability of $1.0 million was mainly attributable to the non-recurrence of a one-off compensation income of approximately $0.7 million recognised in FY 2024, as well as a net change in fair value of an financial asset of approximately $0.2 million recognised in FY 2025 (please refer to details below).

Notwithstanding the above, our business segments have maintained stable gross margins, delivered revenue growth in our core businesses, and continued to drive operational efficiency, highlighting the resilience of the underlying operations.

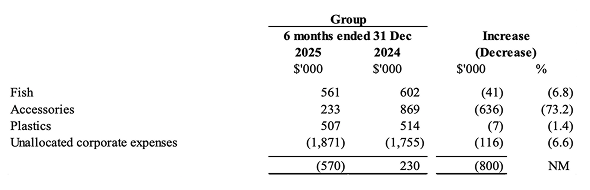

6 months ended 31 December 2025 vs 6 months ended 31 December 2024

Fish

Although the revenue contribution was higher in the 2nd half of 2025, profitability in the fish segment dipped by 6.8% as compared to the corresponding period in 2024, mainly due to lower handling fees from transshipment activities and differences in product mix between the periods. Notwithstanding the lower absolute profit, gross margins remained stable, reflecting the segment's operational efficiency and sustained customer demand, which helped mitigate the overall impact of these factors on performance.

Accessories

The profitability of the accessories segment in the previous financial period included a one-time compensation income of approximately $0.7 million arising from a land expropriation by the local government in China.

Excluding this compensation income, operating profit from the accessories business was marginally higher in the current financial period, as compared to the corresponding period in 2024, broadly in line with the increase in revenue contribution. The improvement in operating profit was further supported by our continued efforts to review and streamline inventory management processes, as well as more favourable margins from the sale of in-house proprietary products, which collectively enhanced the segment's underlying profitability.

Plastics

The marginal reduction in profit generated from our plastic activities in the 2nd half of 2025, as compared to the corresponding period in 2024, was consistent with the lower revenue contribution, coupled with higher raw material costs, increased operational expenses and variations in the product portfolio across the periods.

Unallocated corporate expenses

Unallocated corporate expenses comprised staff costs and corporate and administrative expenses incurred in overseeing the Group's local and overseas operations. The increase in unallocated corporate expenses in the 2nd half of 2025, as compared to its corresponding period in 2024, was mainly attributable to a net change in fair value of an financial asset of approximately $0.2 million recognised in connection with the acquisition of Aquaeasy, partially offset by lower corporate staff costs incurred during the financial period.

Consolidated Statement of Financial Position

Total assets (Group) as at 31 December 2025 were $60.9 million, increased by approximately $2.9 million from $58.0 million as at 31 December 2024.

The increase was mainly attributable to -

- increase in property, plant and equipment of approximately $4.2 million, primarily due to capital expenditure of approximately $3.3 million incurred for the acquisition of a freehold office-cumwarehouse freehold building in Selangor, Malaysia (the “Property”), as well as ongoing enhancements to farms and other facilities in Singapore and overseas, which was partially offset by depreciation charges recognised during the current financial year.

- increase in intangible assets of approximately $0.6 million, arising from the recognition of the fair value of patented AI- and IoT-based technology of $0.4 million and the goodwill on consolidation of approximately $0.4 million, both resulting from the acquisition of Aquaeasy, which was partially offset by amortisation charges recorded during the current financial year.

- increase in biological assets of approximately $0.2 million, primarily driven by changes in biomass volume and the size distribution of breeder stocks.

The above increases were partially offset by -

- net decrease in financial assets at fair value through profit or loss (“FVTPL”) of $0.8 million, mainly due to the derecognition of a convertible loan with a carrying value of $1.4 million, partially offset by the grant of another unsecured convertible loan of $0.5 million to N&E Innovations Pte. Ltd. in July 2025 and the purchase of a life insurance policy for a key management personnel.

- decrease in inventory by $0.1 million resulting from ongoing efforts to streamline our inventory management process so as to better and effectively manage our inventory holding.

- decrease in trade and other receivables outstanding by $0.7 million, primarily due to a receipt of $0.5 million grant reimbursement following the completion of an IT digitalisation project during the 1st half of 2025, coupled with a reduction in advance payments to suppliers for purchases.

- decrease in cash and cash equivalents of approximately $0.5 million, mainly attributed to payments for purchases, settlement of non-trade liabilities, dividend payments, and the cash outflows related to the acquisition of the Property during the current financial year.

Total liabilities (Group) as at 31 December 2025 were $20.0 million, increased by $4.0 million from $16.0 million as at 31 December 2024.

The increase was mainly attributable to higher loans and borrowings of $4.3 million, arising from the drawdown of bank borrowings of $4.0 million, primarily to finance the acquisition of the Property, as well as an increase in lease liabilities following the recognition of additional right-of-use (ROU) assets during the current financial year, notwithstanding regular monthly repayments of lease liabilities.

The above increase was partially mitigated by a decrease in trade and other payables of approximately $0.4 million, mainly due to lower provision for bonuses during the current financial year, in line with the Group's performance.

Consolidated Statement of Cash Flows

Despite the losses recorded, net cash from operating activities for FY 2025 remained comparable to that of FY 2024. This was primarily attributable to a reduction in inventory holdings and the receipt of a grant reimbursement in the 1st half of 2025, partially offset by higher cash outflows for the settlement of payments to non-trade suppliers.

For the 2nd half of 2025, net cash from operating activities was lower, reflecting the losses incurred during the period, although the impact on cash flow was partially mitigated by reduced inventory levels and controlled payments to trade suppliers.

Net cash used in investing activities was mainly attributable to capital expenditure incurred for the acquisition of the Property, as well as ongoing enhancements to farms and other facilities in Singapore and overseas. In addition, the Group granted an unsecured convertible loan to N&E Innovations Pte. Ltd. in July 2025 and made payment for the purchase of a life insurance policy for a key management personnel during the current financial year.

Net cash from financing activities in FY 2025 was largely derived from the drawdown of bank loans obtained from financial institutions, mainly to finance the acquisition of the Property. These inflows were partially offset by the repayment of lease liabilities, payment of dividends to the non-controlling shareholder of a subsidiary and servicing of monthly interest obligations. In addition, there was payment of dividend made to the shareholders of the Company in April 2025.

VARIANCE FROM PROSPECT STATEMENT

There is no variance from the previous prospect statement released via the SGXNET on 18 July 2025.

PROSPECTS

As we enter FY 2026, the global operating environment is expected to remain challenging amid persistent macroeconomic and geopolitical uncertainties. Elevated geopolitical tensions, ongoing regional conflicts, and trade policy uncertainties — particularly relating to tariffs and supply chains — continue to weigh on business confidence and consumer sentiment across multiple markets. While inflationary pressures have moderated in some economies, cost sensitivities and cautious spending persist.

The United States continues to be an important market for the Group, particularly for ornamental fish exports and selected aquarium and pet accessories. Demand conditions have moderated due to tariffrelated uncertainties and higher operating and logistics costs. Nevertheless, underlying consumer interest in essential pet and aquarium products has remained relatively resilient, supported by the nondiscretionary nature of core pet care spending.

Economic conditions in Europe remain mixed, with consumer spending constrained by lingering inflation and higher living costs, leading to more selective purchasing patterns. China's economic recovery remains uneven, affecting both domestic consumption and export-oriented activities. In contrast, ASEAN markets have demonstrated relative stable domestic demand, improving tourism activity and continued intra-regional trade.

Against this backdrop, we have mapped out clear strategic priorities across its businesses, focusing on disciplined execution, productivity enhancement and operational resilience. A key milestone in FY 2025 was the acquisition of Aquaeasy, strengthening our position in the aquaculture sector through AI and IoT technologies that enhance productivity, improve predictability, and support sustainable farming practices. Building on our initial investment via an unsecured convertible loan in December 2021, full ownership of Aquaeasy now provides Qian Hu with greater flexibility and execution control, enabling us to accelerate innovation, scale adoption, and deliver enhanced value to our stakeholders. It also marks an important step in our ongoing journey to transform aquaculture through technology-driven solutions.

Taking these factors into consideration, we believe that our diversified business portfolio, disciplined operations, and ongoing investments in technology and innovation position Qian Hu well to navigate the year ahead.

-

Ornamental Fish business

The ornamental fish segment is expected to remain a stable core contributor in FY 2026. Global demand continues to favour scalable, essential fish varieties over niche or highly specialised breeds. Accordingly, we continue to optimise our species mix and farming footprint to align with prevailing market demand.Investments in controlled farming systems, including the eco-friendly Recirculating Aquaculture Systems (RAS) and Aqua-Ring Technology (ART) system, together with the ongoing redeployment of Arowana ponds, remain central to streamlining operations, managing labour and utility costs, and ensuring a consistent and reliable supply.

We will also invest selectively in breeding, research and quality control of key fish species to maintain product standards, while strengthening supply chain reliability and biosecurity practices.

-

Aquaculture business

Aquaculture is a strategic focus as we advance our technology-enabled farming capabilities. The Group will concentrate on disciplined scaling across our aquaculture operations.The integration of Aquaeasy's digital farm management systems is expected to enhance farm-level real-time monitoring, traceability and resource optimisation, supporting more consistent output and improved cost management over time. With twelve ART systems currently deployed across the Group's farms, measured expansion will be pursued in selected seafood categories such as lobsters, abalone and oysters, subject to market conditions and operational readiness.

In parallel, the Group will continue to work with industry partners to strengthen capabilities in fish diagnostics, probiotics and aquaculture medication, enabling more accurate disease diagnosis and earlier intervention at the farm level.

-

Aquarium and Pet Accessories business

The aquarium and pet accessories segment is positioned to play an increasingly important role in supporting growth from FY 2026 onwards.Across key export markets, demand continues to shift toward functional, consumable and wellnessoriented pet products, particularly within the cat segment. To align with these trends, the Group is placing greater emphasis on pet food, hygiene and care products that generate recurring demand and offer more resilient margins.

The expansion of antimicrobial-based cat products under the “Natureal” range remains a key strategic priority. These products are human food-grade and free from harsh chemicals and alcohol, reflecting growing consumer preferences for safe, gentle and environmentally responsible pet care solutions. The Group plans to roll out the “Natureal” range progressively across selected export markets, subject to local regulatory requirements and market conditions. As local capabilities are developed in selected markets, the Group will also enhance brand visibility through both offline and digital channels, positioning “Natureal” as a cornerstone of its accessories' portfolio.

-

Plastics business

The plastics segment continues to operate on a stable footing, supported by demand from essential applications. We will focus on strengthening cost and process discipline, while selectively exploring new revenue opportunities in line with sustainability, hygiene and functional-use trends.

OUTLOOK

Looking ahead, we will stay focused on disciplined execution of our digitalisation and smart farming strategy. Following the acquisition of Aquaeasy, we will embed digital farm management capabilities into our operating framework to strengthen Qian Hu's presence in the aquaculture sector. These efforts are complemented by enhancements to the Group-wide “One Qian Hu” digital systems, aimed at improving processes, data management and overall operational control.

We will also maintain a prudent approach to capital management. Investment decisions will continue to be guided by cash flow generation, balance sheet strength and long-term strategic alignment, with continued emphasis on cost discipline, risk management and operational resilience.

Barring any unforeseen circumstances, the Group expects to return to profitability in FY 2026, despite prevailing external challenges.